Recent figures from the Office for National Statistics (ONS) confirm that inflation reached 5.5% in January. This marks a near-30-year high, with the Bank of England (BoE) reporting that the figure could peak at over 7% by April.

Rising inflation has combined with fuel bill hikes, low interest rates, and tax increases to plunge many Brits into a cost-of-living crisis. FTAdviser reports that 64% of UK adults are worried about the effect of inflation on their financial plans.

At HDA, the strategies we put in place for you are designed for the long term to ride out short-lived periods of economic uncertainty. We also review your plans regularly to check that you’re still on track to meet your goals.

But there are things you can do now to help lessen the effects of inflation on your household finances.

Keep reading for three simple tips for tackling the cost-of-living crisis.

1. Consider investing in the markets

One of the main ways that inflation affects your finances is by eating away at the value of your money. With interest rates low, the wealth you hold in cash isn’t rising at the same rate as inflation. This means your money is effectively losing value in real terms.

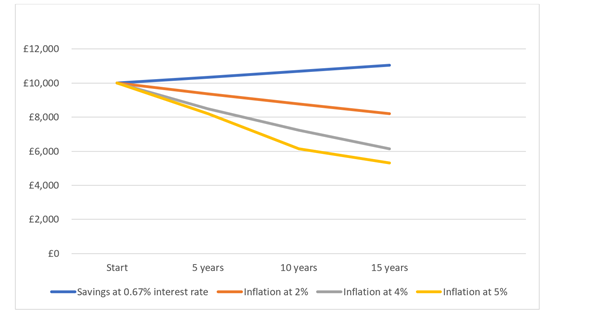

This chart shows the value of £10,000 invested in a savings account with a rate of 0.67%.

Please note: Savings account interest rate taken from Times Money Mentor article with the highest interest rate of 0.67% from Shawbrook Bank. This assumes no tax is paid on the interest. Chart: This assumes that inflation remains at 2%, 4% or 5% for the whole period.

Source: Royal London

You can see that the purchasing power of the money you keep in a high street bank savings account decreases over time as inflation rises. With inflation at 4%, the value of your money will fall by more than a quarter (27%) in real terms over 10 years.

While investing comes with the risk that the value of your fund can fall as well as rise, the biggest risk to your money might be not taking enough risk.

The general trend of the market is upwards and that means that investment over the long term typically has the potential to provide inflation-beating returns.

In 2019, the online trading firm IG calculated the performance of the FTSE 100. It found that over the 10 years to 2019, the index had provided an annualised return of 7.3% (with dividends reinvested).

2. Increase your pension contributions

Your pension is a particularly tax-efficient kind of investment that could also offer inflation-beating returns over the long term.

You receive tax relief at the basic rate of tax for every contribution you make up to the Annual Allowance. This means that a £100 contribution to your pension pot would cost you just £80, with the additional £20 provided by the government.

Tax relief applies for each contribution up to the value of the Annual Allowance, which stands at £40,000 for the 2021/22 tax year (or 100% of your pensionable earnings, if lower). As a higher- or additional-rate taxpayer, you can claim an additional 20% or 25%, respectively, through your self-assessment tax return.

For those paying the highest rate of Income Tax, a £100 pension contribution costs just £55 once the extra relief has been claimed.

Your pension pot not only has the chance to grow through investment returns but also via the effects of compounding.

3. Opt for an inflation-proofed retirement

The options for inflation-proofing your pension don’t stop with the contributions and investments you make. You can choose a retirement option specifically designed to keep pace with or beat inflation.

Many defined benefit (DB), or “final salary”, pensions include an element of inflation-proofing, by increasing the regular income you receive by a set percentage each year. You can choose this same “escalation” for your defined contribution (DC) or “money purchase” scheme.

Choosing an annuity that rises each year will help your regular income keep pace with inflation. You should be aware though, that escalation is more expensive and the starting amount you receive will be lower.

Another option would be to take drawdown. This allows you to withdraw amounts only when you need them. The rest stays invested and so has the potential for investment growth. However, this comes with the risk that the invested fund could decrease, as well as rise, in value.

You’ll also need to ensure you only withdraw what you need. Taking too much out at one time is likely to mean the excess will sit in your cash account, thereby losing value in real terms while interest rates remain low.

Get in touch

If you’re worried about the effects of inflation on your long-term retirement plans, we can help. Please get in touch via email at enquiries@hda-ifa.co.uk or call 01242 514563.

Please note

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation and regulation, which are subject to change in the future.