Instances of fraud increased rapidly last year as scammers took advantage of concerns over the coronavirus pandemic.

While pension and investment scams have been around for many years, the speed with which unscrupulous fraudsters adapted their tactics to incorporate coronavirus scams caught many off guard.

Keep reading to find out how you can keep yourself safe.

The rise of scams

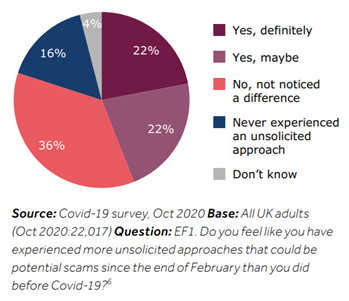

The FCA Financial Lives 2020 survey found that 44% of people surveyed felt that they had received more unsolicited approaches from scammers since the start of the pandemic (up to October 2020).

Source: FCA

The rise in reported scams across the UK in the last twelve months bears this out.

Action Fraud announced a 400% increase in reports for March 2020 alone.

It was followed by reports of “clone firm” investment scams, which increased by 29% as we headed into the first lockdown. These scams cost UK consumers more than £78 million between January and December 2020, with an average loss per person of more than £45,000.

UK Finance meanwhile announced a 20% increase in bank transfer romance fraud between January and November 2020 compared to the same period in 2019, and a massive 84% rise in impersonation scams for the first half of the year.

Pension and investment scams

Canada Life found that pension fraud was the third most common type of financial scam at the start of the pandemic.

Pension scams will often involve claims that a company can help you access your pension early. The minimum retirement age in the UK is currently age 55 (rising to 57 in 2028). Accessing funds earlier than this will usually constitute an unauthorised payment and leave you liable for a 55% charge from HMRC, on top of any fees you pay directly to the scammers.

Defined benefit (DB) transfer scams are also on the rise. Money Marketing reported on the number of DB transfers displaying red flag scam warnings. It reached a record high in November 2020, when 64% of transfers showed signs of being a potential scam.

Red flags

Pension cold-calling was banned in 2019 and although it didn’t stop the practice, it did make scams easier to spot. An unsolicited call about your pension will almost certainly be a scam. Don’t give out any personal information and hang up the phone immediately.

Scammers will try to lure you in. Be wary of phrases such as “take your pension early”, “free pension review”, or “guaranteed returns”. Taking your pension earlier – except in the case of ill health – will almost certainly constitute an unauthorised payment.

Also, be aware that no professional pension provider will attempt to panic you into making hasty decisions with time-sensitive offers. Take the time you need to make an informed choice and speak to us if you are unsure.

Investments that appear too good to be true probably are. If you are offered an unusual or high-risk investment, speak to us before you decide and remember that overseas investments may not come with the same protections as UK-based ones.

Finally, if you have any concerns about a financial services firm, be sure to check that they are on the FCA register and that they are authorised to do the specific work they are offering to do for you.

Bank scams

Research from Santander conducted last year found that UK consumers were at risk of falling victim to a specific type of impersonation scam. When asked if they would transfer money from their account if prompted by someone they believed to be in authority, 45% said they would.

This type of scam is known as an “Authorised Push Payment” (APP). It accounted for a loss to UK consumers of £58 million in the first half of 2020 alone.

Push scams could include calls from scammers purporting to be from the police, HMRC, or your bank (among others) and will explain that your account has been compromised before asking you to authorise moving your money to a new account.

The scam will result in you transferring your savings directly to the scammers.

Red flags

A legitimate organisation will never ask for full account details or passwords over the phone.

If you are worried, hang up at once.

Coronavirus-related scams

Phishing and smishing scams (those received either by telephone or via text message) have targeted fears and uncertainty around coronavirus.

Messages purporting to be from HMRC have offered one-off tax rebates. Others have offered television license refunds.

In January, Action Fraud was forced to issue an alert after receiving more than 1000 reports in one 24-hour period concerning a scam email. It claimed to be from the NHS inviting the recipient to receive their coronavirus vaccine. The link led to a fake NHS site that asked for personal information including bank details. This was a scam.

Red flags

The NHS, the government, and HMRC are all highly unlikely to send genuine texts offering one-off payments, but some scams are subtler and harder to spot. They might use existing templates and are designed to appear genuine.

If you receive an email or text message with a URL link, check the address matches that of the organisation it purports to be from. If it doesn’t, don’t click it. Check the full address that an email has come from to ensure it matches the organisation claiming to have sent it.

Do not give out any personal information if you have any doubts at all.

What to do

You can forward phishing text messages to 7726 and send emails to phishing@hmrc.gov.uk before deleting them, without clicking any links.

Action Fraud can be contacted if you think you have been the victim of the scam. Visit www.actionfraud.police.uk or call 0300 123 2040.

Also, be sure to check the FCA’s ScamSmart site for further information.

Get in touch

If you’d like to discuss any aspect of your financial plans, please get in touch. Email enquiries@hda-ifa.co.uk or call 01242 514563.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation which is subject to change.