Rishi Sunak could be looking to cut the basic rate of Income Tax as early as next year, while the top rate could be scrapped altogether.

Citywire reports suggest that the chancellor will decrease the basic rate of Income Tax by 1% in 2023, with a further 1% drop arriving in time for the 2024 general election. This would see the Income Tax you pay drop from 20% to just 18%.

Meanwhile, the 45% rate paid by additional-rate taxpayers could be scrapped completely, leaving those currently affected paying 40% on all applicable income.

Keep reading to find out what these plans could mean for you.

The Personal Allowance was frozen in the 2021 Spring Budget

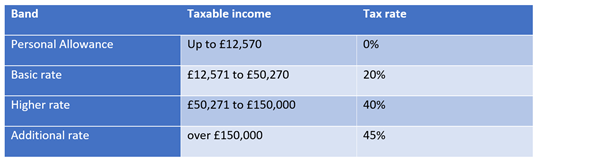

The Personal Allowance is the amount you can earn without paying Income Tax and it was frozen by the chancellor last year. It currently stands at £12,570 and is expected to stay at this level until 2026. It means you can earn £12,570 each tax year without paying Income Tax.

Once your income exceeds this amount, you pay 20% basic-rate tax up to earnings of £50,270, at which point higher-rate tax is payable at 40%. The threshold for additional-rate taxpayers (45%) is £150,000.

Income Tax receipts for the Treasury have doubled in the last two decades, from £93 billion to £187 billion by 2018/19. The Office for Budget Responsibility expects the freeze to the Personal Allowance to push 1.3 million taxpayers into the higher-rate bracket over the next four years.

For those who remain on the basic rate of tax, the possible reduction from 20% to 18% in 2024 could equate to a saving of around £750 a year.

The number of Brits paying the highest rate of Income Tax has increased by more than 10% in the last three years. The scrapping of the highest rate would amount to a tax cut of 5% for the country’s highest earners.

5 simple ways to effectively manage your Income Tax liability

1. Check your tax code is correct

Your tax code will determine the amount of Income Tax you pay so it’s vital your code is correct. Take a look at your payslip to check the code you are on and speak to HMRC if you don’t think it is right.

This could be especially important if you’ve just changed jobs. Starting on the wrong code, or being placed on a temporary emergency code, could severely increase the tax you pay. With the Personal Allowance frozen, it could even push you into a higher tax bracket.

If your code is wrong HMRC should be able to change it so you pay the correct tax in the future and you might even be due a refund of overpaid tax.

2. Consider salary sacrifice

Paying into your pension via your employer’s salary sacrifice scheme (if your company offers one) is a great way to lessen your tax liability.

Salary sacrifice reduces your take-home pay by paying a portion of your pre-tax salary straight into an employee benefit, such as your workplace pension. Not only will you be increasing the size of your retirement fund, but by decreasing your salary, you’ll lower the Income Tax and National Insurance payable.

3. Manage pension withdrawals carefully

The pension withdrawals you take are taxed as income so it’s important you manage the payments you receive.

Pension Freedoms legislation gave retirees greater flexibility in how they accessed their money, but budgeting can be tricky. Taking a single large payment could see you placed on an emergency code, whereas several smaller payments might allow you to remain within your current tax bracket.

You’ll need to carefully manage the tax-free element of your pension entitlement too. At HDA, our team of experts are on hand to offer you professional advice on the most tax-efficient way to access your hard-earned funds.

4. Remember the Marriage Allowance

If you or your partner earn less than the Personal Allowance, the Marriage Allowance allows the lower-earning partner to transfer their unused allowance to the higher-earner (where the higher-earner is a basic-rate taxpayer).

The maximum allowance that can be transferred for the 2021/22 tax year is £1,260, amounting to a potential saving of £250.

5. Make the most of ISAs you hold

ISAs are incredibly tax-efficient. You can pay up to £20,000 a year into the ISAs you hold, with tax-free interest on Cash ISAs and no Income Tax or Capital Gains Tax to pay on gains you make in a Stocks and Shares ISA.

The ISA Allowance can’t be carried over so making the most of the allowance before the end of the tax year could be a great way to manage the Income Tax you pay.

Get in touch

If you’d like to discuss how to tax-efficiently manage your pensions and investments, we can help. Please get in touch via email at enquiries@hda-ifa.co.uk or call 01242 514563.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

Workplace pensions are regulated by The Pension Regulator.