In January 2023, the BBC reported that one-third of the world will be in recession this year, according to the International Monetary Fund (IMF).

While the UK narrowly avoided a recession in the final three months of 2022, times will still be tough for many over the next 12 months.

Inflation remains high, the cost of borrowing is rising, and energy bills are set to soar again from April. Short-term economic turmoil can be worrying but it’s important to remember that it shouldn’t alter your long-term plans.

Despite this, recent research published by FTAdviser has found that two-thirds of UK investors are looking to short-term gains as a way to combat the cost of living crisis.

Keep reading to find out why this is a dangerous approach and what you should be doing instead.

The market outlook for 2023 is gloomy

With war continuing in Ukraine and Jeremy Hunt’s autumn statement “consolidation” set to squeeze household budgets at home, 2023 will be tough for many.

A rising energy bill cap – from £2,500 to £3,000 for the average household – comes into force from April, and pressure will be felt elsewhere too. Cuts to the Dividend Tax Allowance and the Capital Gains Tax (CGT) exempt amount will come into force alongside an extension to the Inheritance Tax thresholds to 2028.

Inflation, at least, is predicted to fall sharply, but only in the second half of the year, while the Bank of England (BoE) base rate is also predicted to rise slightly in the next six months.

The economic outlook in the short-term then is gloomy. But what does that mean for your investments?

Here are three important points to remember.

1. Your investment is based on a long-term goal

The FTAdviser report confirms that two-thirds of UK investors see chasing short-term gains as the best way to manage their investment in the current climate. What’s more, three-quarters feel under pressure to take more risks than they are comfortable with.

Remember that investment is a long-term financial strategy aligned with your goals, with known timescales, and an attitude to risk that matches your profile.

At HDA, we only recommend investing if you have a goal that is at least five, but ideally 10 or more years away. This is because we understand that the stock market can be volatile in the short term. A longer term gives your money a better chance of recovering from short-term blips and a better chance of achieving your goal.

Economic forecasts might seem worrying at the moment but you must remember that if your long-term goal hasn’t changed, then your plans don’t need to either.

2. The stock market isn’t the economy

While the outlook for the global economy in 2023 makes for disappointing reading, it’s important to remember that the stock market and the economy are different things.

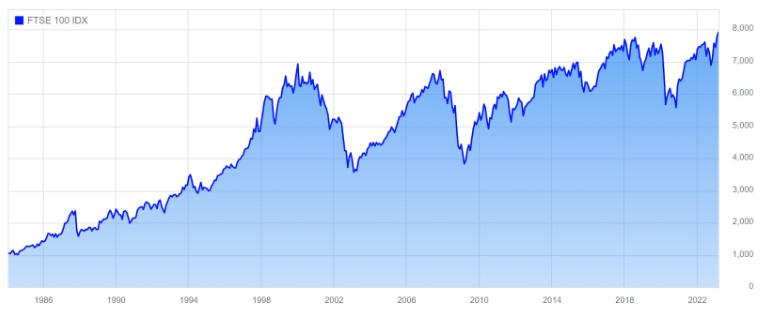

For proof of this, you only need to look at the FTSE 100.

Despite the war in Europe and political upheaval, the index has been rising steadily over the last six months and reached a new all-time high twice in February. In so doing, it broke a record set in 2018.

Source: London Stock Exchange

As well as the index’s 2023 high, you can also see that the general trend of the market is upward. Despite the drops resulting from the 2003 Iraq War, the 2008 global financial crisis, and the coronavirus pandemic in 2020, the rise is clear.

Indexes reflect certain areas of the economy, but your investment will always be diversified to cover multiple asset classes, sectors, and geographic locations. This means that a 10% fall in one sector or region won’t result in a 10% fall in your investment. The hope is that a fall will be counteracted by a rise elsewhere. And all within a generally rising market.

3. Trend-chasing is unlikely to work in the long term

Many unconscious biases can affect the financial decisions we make. Loss aversion can mean you feel losses more painfully than you enjoy gains, while endowment bias can lead to you attaching greater value to the stock you hold.

One of the most damaging biases could be herd mentality, which can see investors copying whatever other investors are doing. This short-term trend-chasing might lead to big returns but the risks are high and the losses could also be large.

Remember that investment isn’t a competition with other investors. Nor is it about making the biggest returns as quickly as possible.

The success of your investment is based on your goal and whether you attain that goal in your chosen timescale while taking a level of risk you are comfortable with.

Get in touch

If you’re worried about the effects of short-term volatility on your investments, remember that staying focused on your long-term goals is key. If you would like further reassurance, or you have any questions about any other aspect of your long-term financial plans, we can help. Please get in touch via email at enquiries@hda-ifa.co.uk or call 01242 514563.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.