On 5 November 2024, US voters will head to the ballots to elect their next president.

While the final nominees won’t be decided until March, it’s looking increasingly likely to be a Biden v Trump race, a rerun of the 2020 election.

At the time of writing, caucuses and primaries are well underway and 2024 promises to be a busy year of campaigning and key political events.

Interestingly, more than 50 countries and more than 4 billion people will be heading to the polls in 2024, making it the biggest election year on record.

The US race, though, with ramifications for global stocks, and even world peace, has the power to affect us all.

Keep reading to find out what the outcome could mean for financial markets and your investments.

US markets will react whichever way the race ends but it could be a choice between poor returns and increased uncertainty

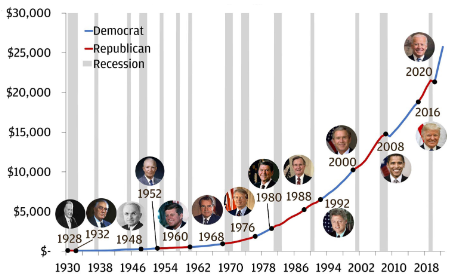

A brief look at the US economy shows a rising GDP (in billions of US dollars) from 1930 to 2023, allowing for short periods of recession, in grey.

Source: JP Morgan

While acknowledging that past performance is no guarantee of a future increase, the chart suggests that the US economy is likely to grow whoever wins the election.

But that doesn’t mean that there won’t be short-term effects. In fact, equities have historically underperformed in an election year.

US News looked at the performance of the S&P 500 since 1952. It found that during that time, the S&P 500 gained an average of 7% during presidential election years. This is slightly less than the average for a “typical” year (10%) but hugely down on the average of 17% for the year before an election.

Generally, according to S&P 500 data, stock market gains tend to be higher when an incumbent president retains power, compared to when a new president is elected.

Whether this would hold in November is hard to say, due in large part to the global uncertainty a Trump win would cause.

Trump means uncertainty but Biden’s record is far from exemplary

As we saw in the UK back in September 2022, markets hate uncertainty.

Kwasi Kwarteng’s mini-Budget under the Liz Truss administration had huge ramifications for investor confidence, and so for UK markets and the economy. The fallout from those announcements continues for, among others, UK mortgage holders.

A Trump win in the presidential election later this year would likely lead to an incredible amount of uncertainty.

Unleashing a well-publicised war on “fake news”, the Washington Post found that Trump himself made more than 30,000 false or misleading claims during his time in office. They described the outcoming of falsehoods as a “tsunami of untruths”.

Having said that, market returns have been below par since Biden came into power.

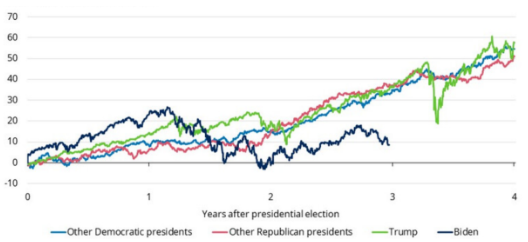

The below chart tracks the percentage performance of a 20/30/10 portfolio over the years following the election:

Source: Schroders

Notes: Total returns from a portfolio comprising 60% equities (S&P 500), 30-year bonds (10-year US Treasury), and 10% cash (3-month US T-bill)

Whether voters choose the uncertainty of Trump or the potential poor performance of Biden, the upshot could be increased volatility for UK markets.

That makes it crucial that you remember some important investment lessons.

3 key factors to keep your investments on track despite global events

1. Markets fluctuate daily but your focus should be on the long term

While we’re looking at the short-term effects of global politics, it’s important to remember that your investment is for the long term. It’s also part of an individual financial plan aligned to your goals.

While markets fluctuate and short-term volatility is to be expected, focusing on your ultimate goals is key.

The general trend of the markets is upward, so a lengthy time frame allows your investment to ride out short-term dips.

Whether those dips are caused by geopolitical events like elections and conflict or events at home, the message remains the same. Stay calm and focus on the long term.

2. The stock market isn’t the economy

As we have seen, a Biden victory could mean continuing sub-par market returns in the US. Conversely, it could also mean a more stable economy.

That’s because the stock market isn’t the economy and vice versa.

Markets are based on the uncertainty or confidence of investors so effectively “price in” expectations. For this reason, the economy might track markets, but the two won’t move in tandem.

3. Your investments are diversified to spread risk

Your fund is invested across asset classes, sectors, and geographical regions as a way of spreading risk.

This is why a 5% drop in the FTSE 100 won’t automatically mean a 5% in the value of your portfolio. It’s also why changes in US markets won’t be suddenly reflected in your fund.

A fall in one region or sector will hopefully be balanced by a rise elsewhere. While it’s interesting to track events in the US, they shouldn’t cause panic at home.

Get in touch

If you have any questions about your long-term plans or you’d like reassurance about your investments in the face of global events, we can help. Please get in touch via email at enquiries@hda-ifa.co.uk or call 01242 514563.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.