Traditionally, an inheritance was left in a will, but a “giving while living” approach has several advantages.

Gifting during your lifetime lowers the value of your estate for Inheritance Tax (IHT) purposes while allowing you to see the difference your money makes. It’s also possible that your beneficiary will receive the money when they need it most.

While most gifts only become free of IHT if you survive for more than seven years after making the gift, certain HMRC exemptions allow for gifts that are IHT-free from the moment the gift is made.

One such exemption is known as “normal expenditure out of income”. It allows you to help your loved ones achieve financial stability while also being tax-efficient. And yet, according to a recent Freedom of Information request submitted by the Telegraph, just 430 people used the exemption in 2022/23.

Keep reading to find out how the exemption works and why it might be right for you.

You can make unlimited “potentially exempt transfers (PETs)” during your lifetime but some gifts are IHT-free from the outset

You can make gifts of any amount you choose during your lifetime, but those gifts could become liable for IHT in certain circumstances, referred to as the “seven-year rule”. For this reason, these gifts are known as “potentially exempt transfers (PETs)”.

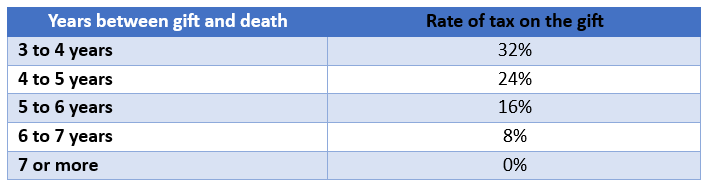

If you die within seven years of giving a gift and there’s IHT to pay on it, the amount of tax due after your death depends on when you gave it. Gifts given in the three years before your death are taxed at 40%, while those given between three and seven years are taxed on a sliding scale known as “taper relief”.

It’s important to note that taper relief only applies to gifts in excess of the nil-rate band (currently £325,000 for the 2023/24 tax year). If no tax is payable on the transfer – because it does not exceed this amount (after cumulation) – there can be no relief. Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.

Source: HMRC

If you have always intended to leave an inheritance to your loved ones, you might consider switching to a giving while living strategy. The earlier in life you give these gifts, the greater your chance of surviving for seven years and those gifts falling outside of your estate.

Some gifts though, are IHT-free from the moment they are made. This is thanks to HMRC exemptions.

HMRC’s gifts from income exemption is a great way to provide regular support but you’ll need to keep your records in order

The HMRC “normal expenditure out of income” exemption allows you to make regular gifts from your income, IHT-free, as long as you can prove that certain criteria have been met.

You’ll need to keep a record of the payments you make in case HMRC requests proof that its rules have been met. Broadly, you’ll need to ensure that the gift:

- Is made out of your usual income

- Comprises part of your normal outgoings

- Doesn’t detrimentally affect your standard of living.

It’s possible that keeping proof of adherence to the above rules is one reason why the exemption is so underused, but we can help to ensure your records are in order.

You’ll need to be able to show that these payments are regular (or that a one-off gift is intended as the first in a series of regular payments) and they should ideally be of similar amounts. It’s also important that the gift comes from income, not capital. You’ll need to evidence that the money is being made out of your pension or employment income, for example.

If making the gift leaves you with insufficient funds to cover your living expenses, HMRC may decide that your standard of living has been detrimentally affected so you’ll also need to be sure that the regular payments are affordable.

Regular gifts can help to provide a stable financial future for your loved ones

Once you’ve decided to provide a regular gift in this way, you’ll need to think about how you want the money to be used.

You might pay straight into a loved one’s savings account, pension, or Junior ISA (JISA) or ISA. This could help to improve your loved ones’ financial stability while also being tax-efficient for you.

Where you pay the money will depend on the type of help you want to offer. You might pay into an account used to cover private school fees. A JISA for a younger child, meanwhile, could provide a fund to help with education costs in the future.

Equally, you might decide to pay into a child’s pension. This will tie the money up until the child reaches the minimum retirement age (55 currently, rising to 57 in 2028 and likely to be higher still by the time a child is ready to retire).

This gift, though, could provide much-needed stability in later life, as well as set a good example of how to plan for the future.

Get in touch

If you’d like help giving while living using the regular expenditure from income (or any other) exemption, please get in touch via email at enquiries@hda-ifa.co.uk or call 01242 514563.

Please note

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

Remember, taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief. Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.