The phrase ‘cash is king’ – often attributed to Volvo CEO, Pehr Gyllenhammar – is one you’ll have heard often.

In the short-term, cash offers secure, easily accessible funds, protected from market volatility. Over the longer term, however, inflation can devalue your cash savings in real terms.

Some low-risk investment might be required simply to maintain your current wealth.

The long-term approach, a stock market investment as part of a portfolio aligned to your risk profile and future aspirations, has the potential for significant growth.

The benefits of cash in the short-term

Holding liquid assets means you have easy and quick access to your cash, and you can spend it, however, and whenever you wish.

The year so far has seen periods of significant short-term volatility brought about by the coronavirus pandemic. In March, the BBC reported that the FTSE 100, the Dow Jones and the S&P 500 all suffered their steepest daily falls since 1987.

The FTSE 100 went onto post its best quarterly gains in a decade for the second quarter of this year, as reported by the Telegraph.

In the meantime, those whose wealth was held in cash remained unaffected.

With no risk of it losing value during a stock market fall, money held in cash is great for an emergency – ‘rainy day’ – fund. There’s no risk of your cash amount falling, and you have the peace of mind that you can access it quickly if needed.

You have the added security of the Financial Services Compensation Scheme (FSCS) too. Should your bank or building society fail, your savings will be protected, up to the value of £85,000 per person, or £170,000 for joint accounts.

What about the impact of inflation?

It might seem as though cash is indeed king. If you’re looking to save money for the short term – you anticipate needing quick and easy access to it within the next few years, say – cash may well be your best choice.

If you are particularly risk-averse, this might seem like the only option. But be sure to factor in the impact of inflation.

With the Bank of England base rate currently at just 0.1%, your savings won’t be keeping up with the cost of living. Your money could be losing value in real terms.

What does historic stock market performance look like?

Investment comes with a certain level of risk, albeit matched to your risk profile. You could get back less than you put in, but there’s growth potential too.

When looking at the benefits of the long-term approach, its important to understand historic stock market performance.

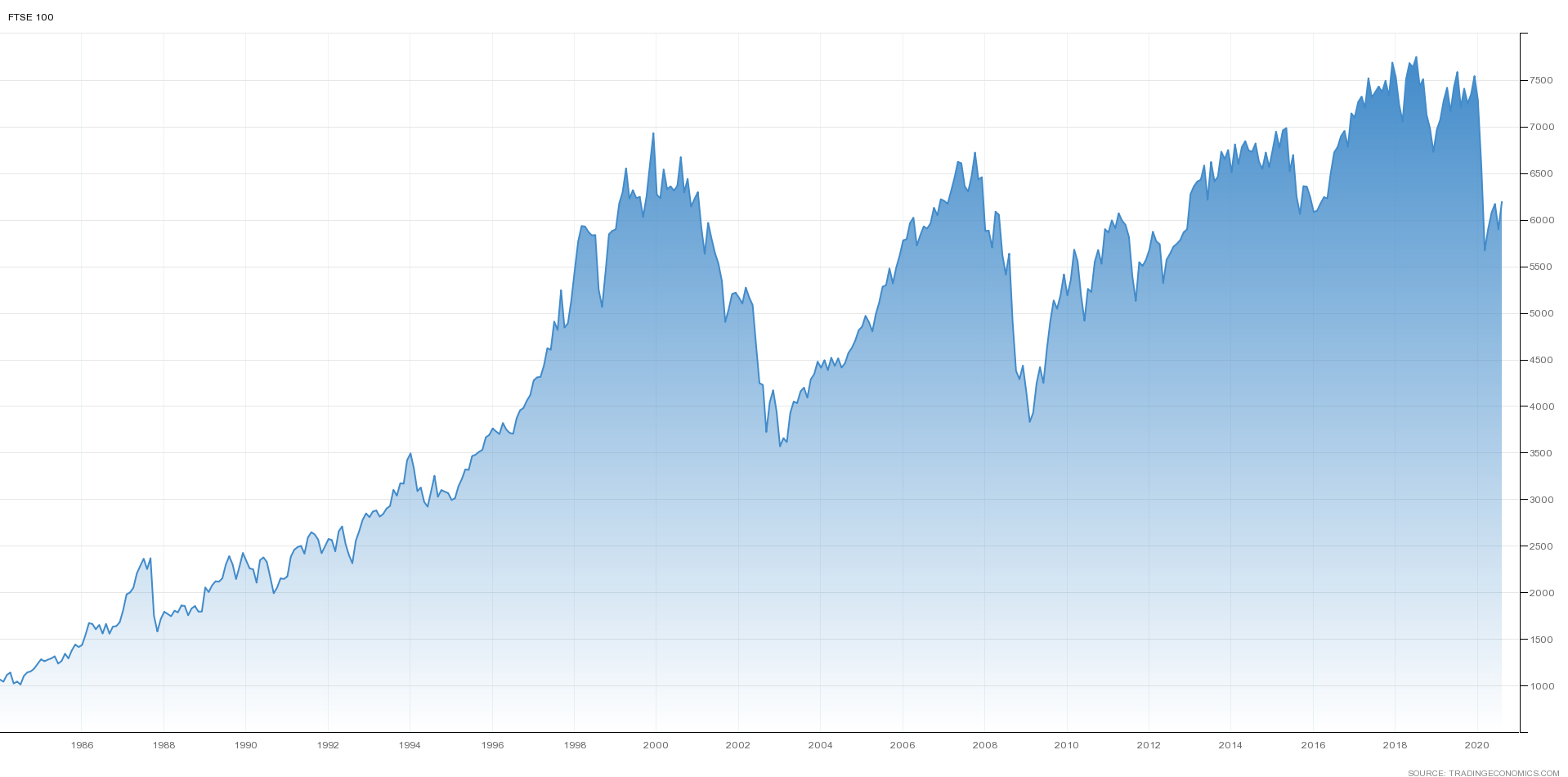

Source: Trading Economics

Let’s look at the FTSE 100 since 1984. There are obvious blips. The 2008 global financial crisis, the economic downturn of 2003 sparked by worries of the impending war in Iraq, and the significant market downturn at the start of 2020 resulting from the coronavirus pandemic, for example.

But the general upward trend is clear.

Online investment platform IG Markets Ltd looked at the average returns on the FTSE 100 over the past 25 years. They found that total returns were +380.52% with dividends reinvested or a 6.47% annualised return.

That means that £10,000 invested in the FTSE 100 at the start of 1986, with dividends reinvested, would have grown to £195,852 by 2019. The figure would have been £53,394 if the dividends received were not reinvested.

The benefits of investing for the long term

If you’ve heard the phrase ‘cash is king,’ you’ll likely also have heard ‘it’s time in the market, not timing the market.’

Investment is a long-term prospect. We’ve seen that the markets describe a generally upward slope, but the only way to take advantage of that trend is to invest and stay invested – even when times are hard.

The emergence of coronavirus caused a large amount of stock market volatility earlier this year, but remember:

- the general trend of the markets is an upward one – this should give you confidence during difficult times

- avoid emotional, knee-jerk reactions – remaining invested gives you the best chance of seeing returns when the market improves

- your goals are long-term ones – if your financial aspirations haven’t changed then your long-term plan doesn’t need to either

Whether you are new to investing or looking to rebalance an existing portfolio, we can help to ensure your investments are diversified in a way that that spreads investment risk, matches your profile, and helps to achieve your financial goals.

A plan for the long-term gives you the best chance of seeing returns on your investment, so speak to us now.

Get in touch

If you’d like to discuss any aspect of your investments, or your long-term financial plan, get in touch. Please email enquiries@hda-ifa.co.uk or call 01242 514563.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.